Securing a home loan approval can be a little like having a 20 dollar bill in your pocket. Once that first transaction is complete, it seems much easier to spend the rest of it.

Filling out the loan papers and receiving a pre-approval can get very exciting. Planning for a new house can take us down many inspiring roads. Maybe you start thinking about the new eight piece set dining room furniture you just saw on the showroom floor – no interest for six months! Or since you’ve been pre-approved for a mortgage, now seems like the perfect time to upgrade to that all too intoxicating new car smell.

Afraid not! Now is the perfect time for patience when it comes to navigating the home buying process.

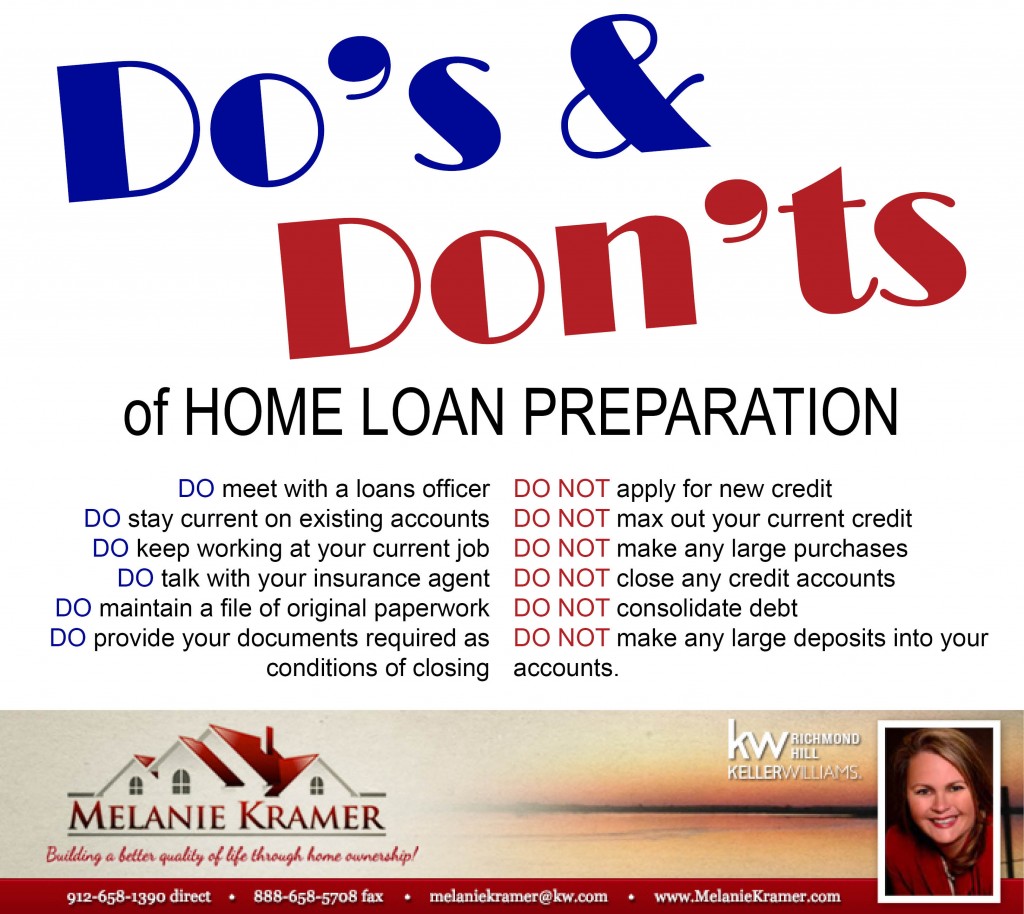

Do’s and Don’ts of a Smooth Home Loan Approval

- DO NOT apply for new credit. This includes those no payments, no interest for 6 months promotions and co-signing for anyone.

- DO NOT max out your current credit or make any large purchases. Budgeting for your new home is important. Waiting until all the paperwork is finalized before adding to the debt will make for a smooth home buying experience.

- DO NOT close any credit accounts or change banking accounts. Accounts with zero balances with access to available credit can help your credit rating.

- DO NOT consolidate debt. Looking at our credit reports can get a little scary, especially if you haven’t been keeping up with them. Now is not the time to consolidate debt, doing so is essentially applying for new credit.

- DO NOT make any large deposits into your accounts. During the home loan application personal accounts are monitored for general activity and balances. Large deposits can raise red flags. If you receive a monetary gift it is good practice to keep a paper trail on hand.

- DO NOT originate any inquires on your credit. This is an activity for your mortgage lender!

The goal is to maintain the credit profile that ensured the pre-approval. If you’re about to engage in activity that will change your credit it is always best to get a second opinion – which brings me to the Do list.

- DO meet with a loans officer. They are here to help answer any questions specific to your needs.

- DO stay current on your existing accounts. Buying a new home can take up a lot of time and energy. Now is the perfect time to stay vigilant on your current payment schedules and ensure everything remains up to date.

- DO keep working at your current job. Change is great. And a lot of people move because of their work. But when that isn’t the case, maintaining your work history will help turn the pre-approval into a closing as stress free as possible.

- DO keep your insurance agent in the loop. Open a dialogue with your insurance company early in the home loan approval process and let your agent, insurance carrier and lender know the name, address and telephone number of your local insurance agent and company insuring your new home with homeowners insurance coverage and/or flood insurance. The agent must send a declaration page of insurance and bill to the closing attorney prior to closing.

- DO maintain a file of original paperwork. Having pay stubs, W-2 forms, past tax returns, bank statements, insurance documents, VA certificate, etc on hand is a great way to quickly fix up an issue that may arise. Consider using a folder or a small binder to keep everything organized.

- DO provide your lender with any documents required as conditions of closing i.e. a closing statement from the sale of your prior home, your last paycheck, an original gift letter, copies of tax returns

- DO let the closing attorney and your agent know if a Power of Attorney is needed. An executed Power of Attorney for anyone on the loan who is NOT able to attend the closing will be needed. The Power of Attorney must be faxed to the closing attorney prior to closing to ensure the Power of Attorney is approved by the lender.

Please feel free to contact me questions and if you consider moving to the area, upgrading to a larger home in the area, purchasing land or investing in a business here, I would greatly value the opportunity to meet with you.

Warmest regards,

Melanie Kramer, Realtor